Give To Causes You Care About And Believe In.

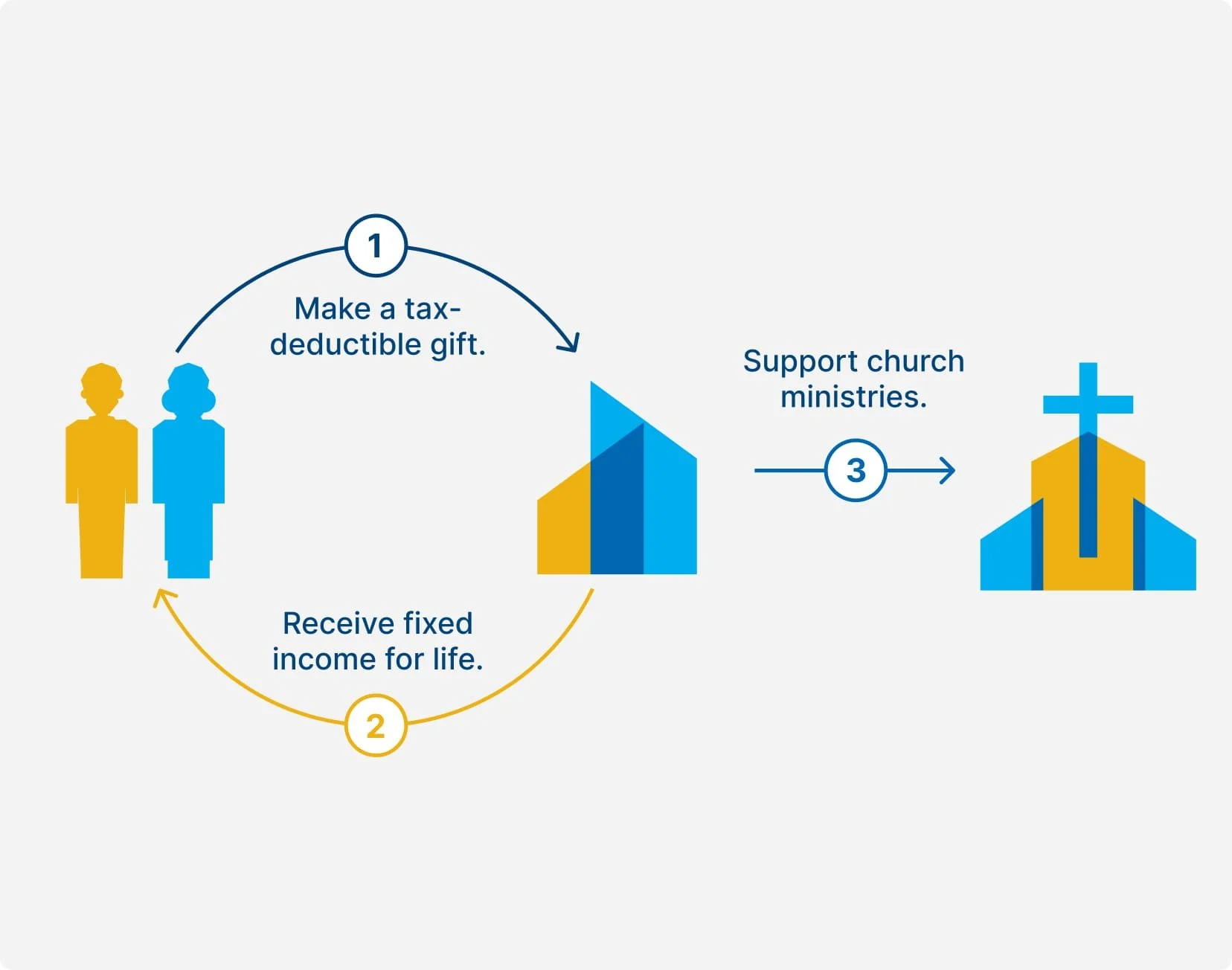

How A Charitable Gift Works

A Charitable Gift Annuity is a contract between you and CFR whereby a donor makes a gift of assets or cash in exchange for our promise to pay you a fixed income for your life. You will receive a charitable deduction for the value of your future gift to us, plus the satisfaction of knowing you are helping to fund ministry and change lives.

Christian Financial Resources is dedicated to supporting

churches in their life-changing work.

If your life has been positively impacted by the church and you’re looking for a way to give back, a CGA can be a powerful giving tool. If you desire to continue seeing the gospel shared in local churches, consider the positive impact a CGA can have.

Provides you with a fixed-income for life.

Fulfill your financial tax, and estate planning goals.

Create a lasting impact in the ministry of CFR.

Example

David creates a CGA with Christian Financial Resources, with an initial gift of $10,000.

CFR agrees to pay David a fixed amount of income each year for the rest of his life, based on his age and the current gift rates. Let's assume the current rate for a 65-year-old is 5.7%, so David would receive an annual payment of $570.

David also receives an immediate tax deduction of approximately $3,500 based on the present value of the future income payments and his age. At the end of his life, any remaining balance of the CGA would go to Christian Financial Resources as a charitable gift.

| One-Life | Two-Life |

|---|

RatesGift annuities are backed by the assets of Christian Financial Resources |

|||||

RatesGift annuities are backed by the assets of Christian Financial Resources |

AGE | RATE* | AGE | RATE* | |

| AGE | RATE* | AGE | RATE* | ||

| 65 | 5.70% | 65/70 | 5.20% | ||

| 75 | 7.00% | 70/75 | 5.80% | ||

| 85 | 9.10% | 80/85 | 7.30% | ||

| 90 + | 10.10% | 85/90 | 8.70% | ||

FACTS

The minimum amount required to establish a Charitable Gift Annuity through Christian Financial Resources is $10,000.

The rate of return is typically from 5%-10%, based on the donor’s age, and depends on whether one or two people will receive income from the gift.

You cannot add to a Charitable Gift Annuity but you can establish additional income agreements at any time.

The annuity is an irrevocable agreement.

Christian Financial Resources has already funded over 950 projects in the United States. With your Charitable Gift Annuity, you are partnering with us in continuing to expand the Kingdom of God and changing lives forever.

Your money is used to Fund Ministry and Change Lives.

FAQ

Charitable Gift Annuities offer many benefits. If your question isn't listed here, consult a team member today.

-

Donor receives an income tax deduction in the year that they establish the annuity for the gift portion of the contract.

Donor receives a fixed periodic income that is not affected by the fluctuations of the marketplace.

Donor receives a portion of their annuity income free of federal taxes.

-

The minimum amount required to establish a Charitable Gift Annuity through Christian Financial Resources is $10,000.

-

The rate of return is typically from 5%-10%, based on the donor’s age, and depends on whether one or two people will receive income from the gift.

-

Donors cannot add to a Charitable Gift Annuity but can establish additional income agreements anytime.

-

No, the annuity is an irrevocable agreement. This contract cannot be canceled and is final once the contract is signed and Charitable Gift Annuity has been established.

Charitable Gift Annuity Forms

The following forms are available for download in PDF format: